SCIF Leasing and Financing Options

Secure, Compliant and Cost-Effective SCIF Leasing by APC

Building or buying a Sensitive Compartmented Information Facility (SCIF) can demand an upfront investment of over £1,000,000. For many organisations, this creates a barrier to accessing the secure infrastructure they need. APC provides flexible leasing options for SCIFs that meet full UK NPSA compliance, giving clients accredited, secure facilities without tying up valuable capital.

By choosing to lease, organisations can reduce their first-year outgoings by up to £890,000* compared to purchase, while still meeting the same strict accreditation standards for security and compliance.

*Figures shown are for example purposes only; actual costs will depend on project requirements.

Why Lease your SCIF?

Leasing a SCIF delivers cost savings, financial flexibility and built-in compliance. Prefabricated units can be ready up to 40% faster than traditional builds and can be scaled or relocated as needs change.

| Lower upfront costs - Avoid £1,000,000+ purchase costs and preserve capital | |

| Cash flow advantage – Save up to £890,000 in year one compared to buying | |

| Long-term savings – leasing can save £1.6–£1.8 million over five years |

Want to see the full cost comparison and hidden benefits of leasing? Read our detailed guide:

Lease Model Comparison

Three primary lease models have been analysed for APC Technology SCIFs: Simple Lease, Finance Lease, and Operating Lease. Each model offers distinct advantages and cost structures that affect both short and long-term financial implications.

Simple Lease Model

Fixed, predictable monthly payments with minimal upfront commitment.

- Example 5-year payment: £19,444.44/month

- Annual capital component: £76,666.67

Best for straightforward budgeting and rapid deployment.

Finance Lease Model

Loan-like structure with interest, potential tax benefits, and a path to ownership at term end.

- Example 5-year payment: £22,249.30/month

- annual capital component: £110,324.93

Ideal where eventual ownership is strategic.

Operating Lease Model

Treats the SCIF as a managed service. APC retains ownership; SLAs cover maintenance/compliance, reducing obsolescence risk.

- Example 5-year payment: £19,722.22/month.

- Flexible options at end of term.

Keep secure, modern facilities without tying up capital.

Detailed Cost Breakdown Analysis

The cost structure for SCIF leases includes several key components beyond simple capital recovery, many of which are consistent across different lease models. Understanding these components is crucial for evaluating the true cost of SCIF acquisition and operation.

Primary Cost Components

For a 5-year lease term, the breakdown of annual costs reveals that capital recovery represents only 32-41% of total costs, with the remainder comprised of operational expenses.

Capital Recovery

Portion of total costs in Simple Lease model.

Operational Expenses

Remainder of total costs across all lease models.

Annual Operational Expenses

- Maintenance fees: £50,000

- Security testing and accreditation: £36,667

- Utility costs: £40,000

- Refurbishment provisions: £30,000

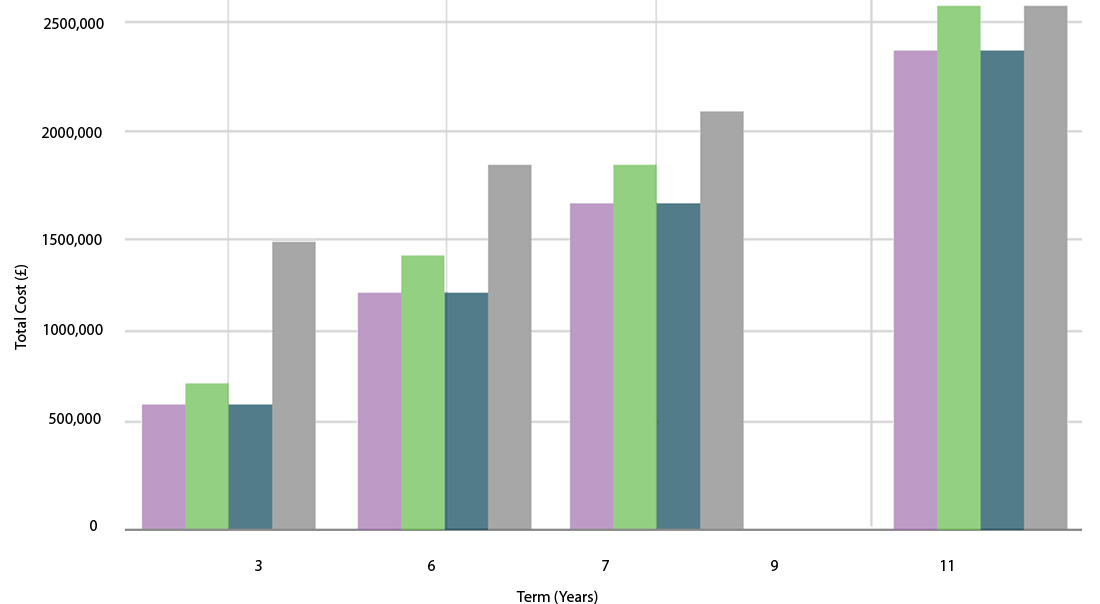

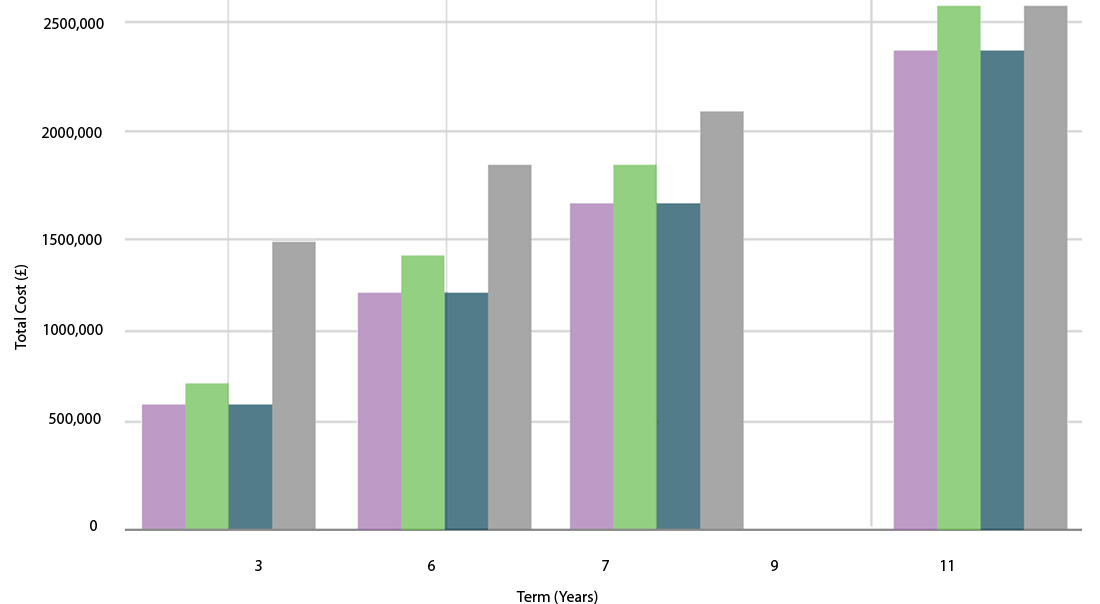

Cost by Term & Method

| Simple Lease | Finance Lease | Operating Lease | Purchase |

Financial Advantage of Leasing vs. Purchasing

When all costs are considered, including hidden expenses, the financial advantage of leasing over purchasing is substantial across all analyzed lease terms. This advantage is particularly evident in first-year cash flow impact and total cost over the lease term.

Cash Flow Impact Analysis

The first-year cash flow impact reveals a dramatic difference between purchase (£1,126,667) and leasing options (£203,333 - £266,992), representing a cash flow advantage of approximately £890,000 for leasing arrangements.

Total Cost of Ownership Comparison

Over a 5-year period, purchasing (£2,948,333) is significantly more expensive than any leasing option (£1,166,667 - £1,334,958). This difference represents a financial advantage of £1,613,375 - £1,781,667 for leasing arrangements.

Recommended Lease Arrangements

Based on comprehensive financial analysis, the Operating Lease model provides the best overall balance of cost, flexibility and risk mitigation for most organisations. With monthly payments similar to the Simple Lease but greater operational flexibility and reduced technological obsolescence risk, this model aligns well with the dynamic security environment.

Leasing arrangements for APC Technology SCIFs present a financially viable and operationally advantageous alternative to outright purchase, with potential savings exceeding £1.7 million over a 5-year period when all costs are considered. By adopting the recommended lease arrangements, organisations can maintain state-of-the-art secure facilities while preserving capital, improving cash flow and reducing exposure to technological obsolescence.

Your Certified Partner for Secure, Compliant SCIF Projects

Ask a Member of our Expert Team

Have more questions regarding SCIFs - or need advice and support for planning your own Secure Compartmented Information Facility? Our team are on hand to answer your questions and share the technical insight we have to ensure you meet your project requirements.

Request a callback from a member of our technical team to get dedicated one-to-one consultancy for your SCIF requirements.

Your Certified Partner for Secure, Compliant SCIF Projects

With 40+ years’ experience, APC Technology Group supplies genuine, traceable MIL-STD components and systems for Naval, Land and Avionic applications. As a distributor for 100+ specialist manufacturers, we deliver secure, high-reliability solutions backed by BS EN 9120, ISO 9001, Cyber Essentials Plus, AS9120 and ADS Group accreditation, ensuring trusted quality and compliance for mission-critical projects.